our services

How to Create A FIXED DEPOSIT with your Remittance

You can ensure that you receive the highest interest rates thru Rastriya Banijya Bank when you send a remittance into Nepal from overseas and click on Fixed Deposit (FD) creation.

Here are the steps to create your FD

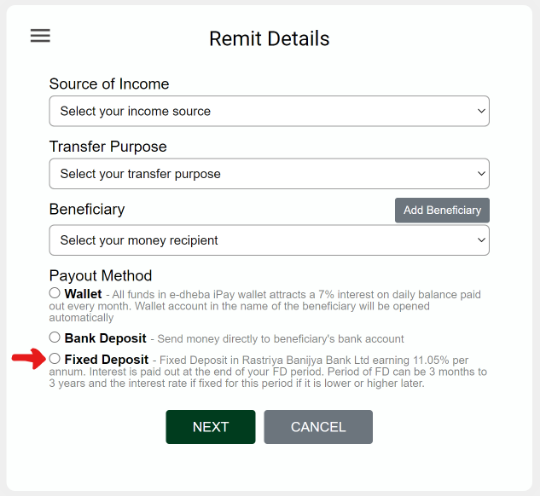

STEP 1:CLICK ON FD WHILE SENDING MONEY

Once the beneficiary requests for remit, sender have to choose Fixed Deposit option while sending money.

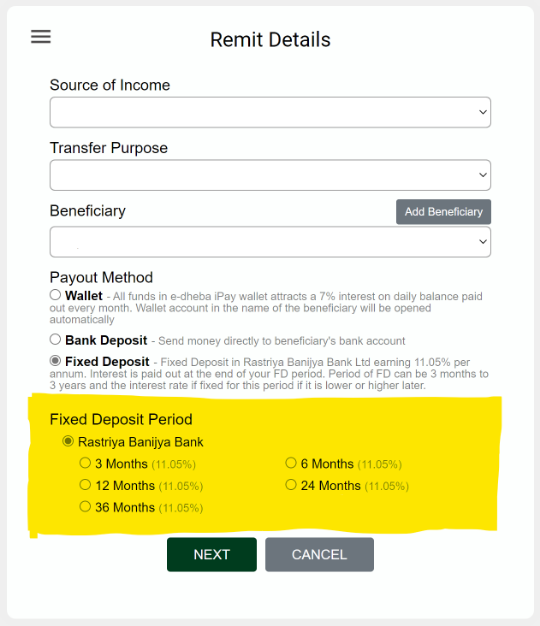

STEP 2: CONFIRM THE INTEREST RATES AND PERIOD OF FD

After choosing Fixed Deposit option, sender have to confirm time period for fixed deposit. Note: Interest rate shall vary according to chosen time period.

STEP 3: INTEREST POSTING METHOD

Interest is posted at the end of the period of your Fixed Deposit and you will be able to withdraw both interest and principle amount together.

STEP 4: HIGHEST INTEREST RATE

Now beneficiary can enjoy INTERESTING INTEREST from their Fixed Deposit. This is the highest interest rate that any financial institution can provide in Nepal and special approval provided for remittance coming into Nepal.

Fixed Deposit in Whose Name?

The Fixed Deposit will be opened in the name of the Beneficiary who is in Nepal and not the sender in overseas country.

Is the Fixed Deposit Account with Lalit Money Transfer or with Rastriya Banijya Bank Ltd?

Lalit Money Transfer has only partnered with Rastriya Banijya Bank Ltd to provide this service. The funds are going to be with Rastriya Banijya Bank Ltd and they are the bank that is going to be providing you the interest on your deposits.

Do you need any other documents to open my Fixed Deposit?

If there are any requirements for KYC documents to be filled up to open your Fixed Deposit Account, we will contact you again if we do not have adequate information with us.

Can I Open My Fixed Deposit Account in Another Bank?

Currently we have signed up with Rastriya Banijya Bank Ltd and all remittance are eligible for Fixed Deposit Account in RBB if the funds are coming from remittance thru Lalit Money Transfer or its affiliates and partners like Unlimited Remit and Muncha Money.

What is the Minimum Amount for my Fixed Deposit

The minimum amount for the Fixed Deposit Account is NPR 5,000 (Nepalese Rupees five thousand only).

Can I Open A Fixed Deposit Account even if I have not received a Remittance?

No. This special high interest rate has been approved by Nepal Rastra Bank for monies coming from Remittances only.

Do I have to Open a Fixed Deposit of the full Amount of my Remitance?

No. You can put partial amount of your remittance into Fixed Deposit, it does not have to be the full amount. For Example, you remittance could be for NPR 10,00,000 (Nepalese Rupees ten lakhs only) and you can open the Fixed Deposit Account for any amount of over NPR 5,000 (Nepalese Rupees Five Thousand only).

Can the Fixed Deposit be opened in another person's name?

No. This Fixed Deposit Account can only be opened in the name of the Beneficiary of the Remittance.

In case in future I need to take a loan against my Fixed Deposit, is this possible.

Yes, you can definitely take a loan against your Fixed Deposit Account as per the rules and regulations of Rastriya Banijya Bank.

Can I close my Fixed Deposit Account before its maturity?

Yes this is possible. There might be some fees you might have to pay at the time of premature account closure as per the rules and regulations of Rastriya Banijya Bank Ltd at the time of closing the account.