All of these instances are changes in the industry brought by technology in very short time span.

Now in the remittance industry, we are also seeing the Cash Pick Up agents dying its natural death. There used to be a time a couple of years ago where every remittance company used to boast about nearly tens of thousands of agents that they have all over the country in Nepal who are providing the service of paying out the cash for the remittances received.

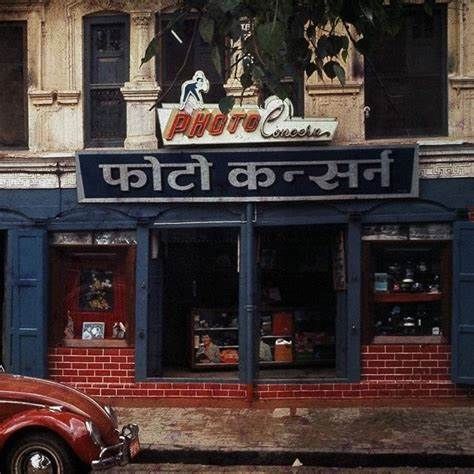

With everyone having a mobile phone in their possession, the ability to receive SMS notifications when the remittance has arrived, and when the funds have been deposited in their bank accounts, all of this in realtime literally around the close 24 X 7; the role of the cash pickup agents seems to be diminishing. People do not prefer to go to a brick=and-mortar shop to receive their funds.

Here are some reasons why:

High Costs:

In this digital world, where real time payouts to the beneficiaries bank account and wallets can happen around the clock at very low costs, the cost of the transaction costs for these cash pick up agents seems to be difficult to sustain while the margin in the transactions are getting thinner.

Manpower:

To manage this large network of agents, every Money Transfer Organization (MTO) needs a large workforce to coordinate with the agents.

Liquidity:

Many times, these agents request for the amount to be deposited in their account so that they can payout the customer. The amount of phone calls that keeps on coming for the support of such interactions with the agents do take up quite a bit of time, effort and resources.

Branding the agents:

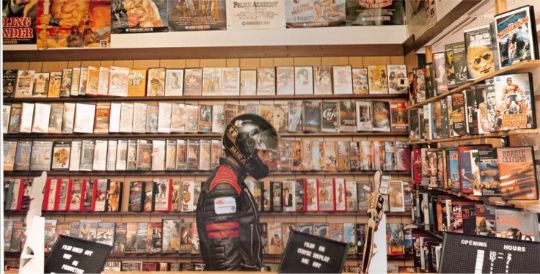

The agents need to be constantly updated with branding signs, posters, pamphlets which becomes one of the larger expenses for the MTOs.

Unethical practices:

Some of the agents use unethical means while doing the transactions like locking the transaction and giving the amount to the beneficiary in installments.

It has also been reported in the media that these agents try to woo the beneficiary to park the amount received thru remittances either in deposit accounts in local cooperatives that they run, lure them into buying various assets, land and property.

Real-time:

In today’s world deposits into both bank accounts and wallets is possible in real time and 24 X 7. The transactions have gone cashless. They say cash is king, and the king has been deposed in Nepal. So cashless is cool.